Little Known Facts About Wyhy.

Little Known Facts About Wyhy.

Blog Article

Everything about Wyhy

Table of ContentsThe 25-Second Trick For WyhySome Known Incorrect Statements About Wyhy Examine This Report on WyhyThe 15-Second Trick For WyhyAll About WyhyNot known Factual Statements About Wyhy

Longer terms can alleviate up the loan. It will be very easy to return the lending, and you will have a longer time for it. You will certainly need to pay lower regular monthly settlements for the watercraft financing since credit rating offers much longer terms for watercraft lendings than local banks, to make sure that monthly payments will be lower.

A boat lending can be used to finance additional digital devices. It will be beneficial for you to acquire new items for the boats to make your time on the water very easy.

How Wyhy can Save You Time, Stress, and Money.

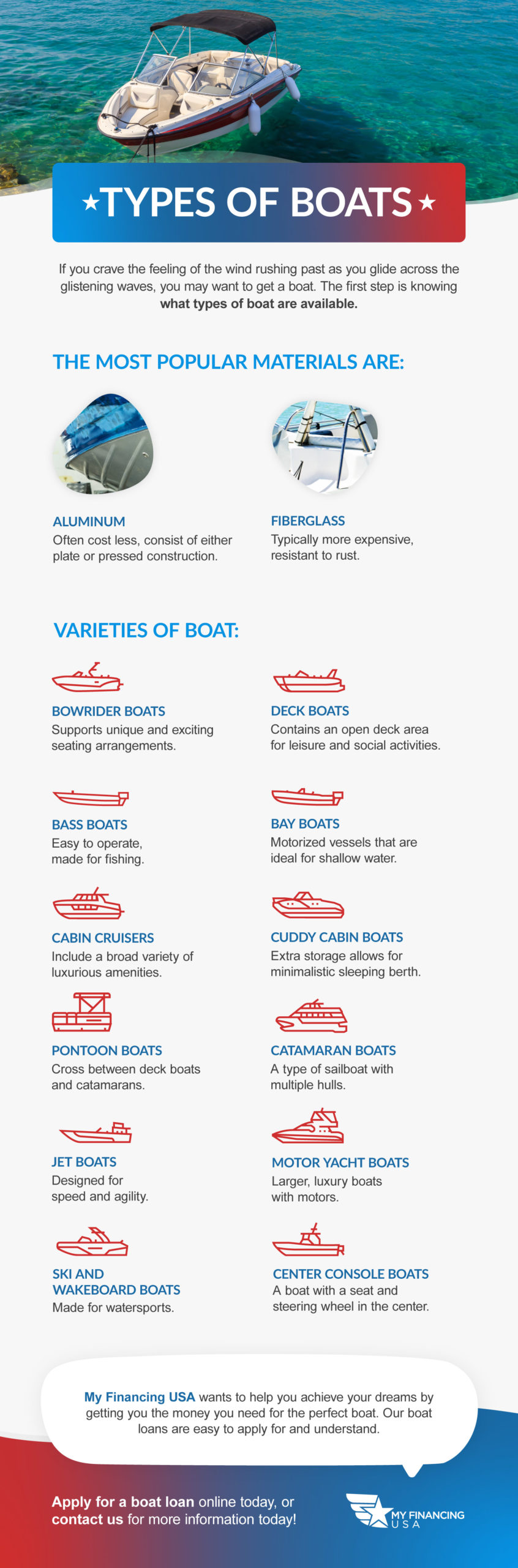

Utilized watercraft fundings might in some cases have greater rates than brand-new watercrafts, it is not always the instance. Numerous lending institutions provide affordable prices regardless of whether you are getting new, utilized, or refinancing. Discover current prices and make use of a finance calculator to approximate your car loan repayment. As the warmer weather methods, that imagine riding the waves in your watercraft can be a truth.

"There are pitfalls, or 'shoals' as we like to state, in boat financing, however that's where we stand out, at browsing the ins and outs and revealing any kind of hidden dangers," said Rogan. "As an example, often there is a concern with transfers between previous proprietors, or we might need to do a title search with the Shore Guard.

Wyhy for Dummies

"There are no techniques when it pertains to getting approved for a watercraft lending, but there are some approaches that we can make use of to make certain your monetary situation is stood for appropriately," noted Rogan. "We've dealt with a number of the same lenders for several years and recognize what they are trying to find and how to make certain that your details is presented in the finest possible light." The ideal choice for a watercraft funding is nearly constantly a marine lender that focuses on boat loans.

"Lenders who specialize in boat fundings normally have a much better understanding of watercrafts and their buyers," claimed Rogan. Watercraft loans utilized to be more minimal in size and with bigger down repayments; today, terms of 10 to 20 years are rather common.

Determine and price the precise watercraft you desire. Determine and price the watercraft insurance you need. Start the purchase. If it seems simple, well, that's because it is. The majority look these up of new watercrafts are bought with a funding, so reputable treatments remain in area. As for who to obtain the finance from, you'll have three standard choices to pick from: This is generally the very best wager.

The Only Guide for Wyhy

They can usually aid with some referrals for setting up insurance policy, also. Some customers that have a great deal of equity in their home discover it beneficial to secure a home equity funding or a bank loan, either because they may get a lower rate of interest or for tax functions.

Given that funding a watercraft is a bit various than funding various other points, there are some lending institutions that concentrate on it. As a matter of fact, there's even a company, the National Marine Lenders Organization, made up of lenders who are familiar with all the ins and outs of making watercraft finances. When you obtain your boat funding, just what will the repayments be? To get a good concept of just how the month-to-month expenditure for various finances will certainly tremble out, utilize our Boat Loan Calculator.

The smart Trick of Wyhy That Nobody is Discussing

Credit history, financial debt ratios, and total assets might all be thought about by the lender, essentially depending upon your personal circumstances and the dimension and term of the loan. Nonetheless, there are a few abstract principles that are true for the vast bulk of watercraft financings: Rate of interest typically drop as the lending quantity goes up.

Greater loan amounts can generally be stretched over longer periods of time. In many cases, boat fundings vary from four to 20 years. Usually, the loan provider will certainly be basing a watercraft lending on a 10- to 20-percent down-payment. That said, there are some no-money-down offers out there. Commonly, you can roll the expenditures of accessories like electronics, trailers, and even extended guarantees into a boat funding.

8 Easy Facts About Wyhy Shown

A lot of loan providers will be looking for credit rating of about 700 or greater. You can get a boat loan with a reduced credit history score, but anticipate that you may need to pay a charge in the form of a greater interest price or a bigger down-payment. Make certain to review Funding & Watercraft Loans: Handy Information for Watercraft Ownership to get more information concerning a few of the finer points of financing a boat.

Securing a finance to acquire a boat is a lot like taking out a car loan to get a vehicle or a home. You can get a secured boat funding that uses the watercraft as security or an unprotected finance that will certainly bring a higher rates of interest and a reduced loaning limitation.

Report this page